cumulative preferred stock dividends in arrears

A company can have several consecutive quarters. All passed dividends on a cumulative stock make up a dividend in arrears.

Solved Dividends Per Share Zero Calories Company Has 16 000 Shares Of Cumulative Preferred 1 Stock 40 Par And 80 000 Shares Of 150 Par Common S Course Hero

The Bottom Line A.

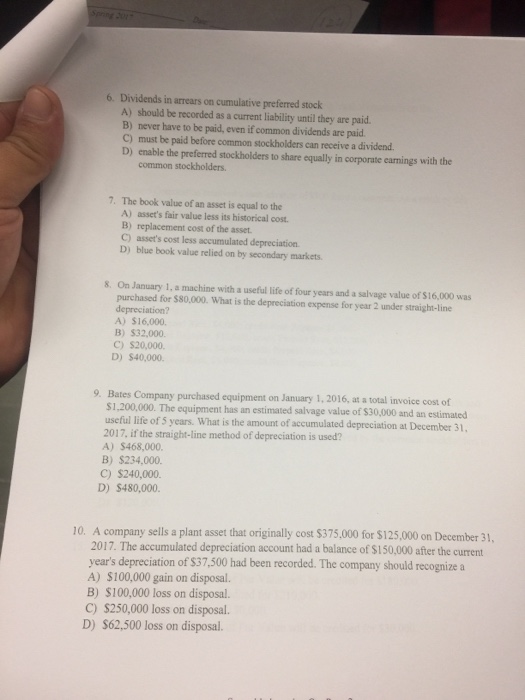

. Dividends in arrears on cumulative preferred stock A should be recorded as a current liability until they are paid. B never have to be paid even if common dividends are paid. Once all cumulative shareholders receive the.

Definition of Dividends in Arrears. Robbins Petroleum Company is four years in arrears on cumulative preferred stock dividends. If and when the cumulative dividends in arrears are paid the payments go to the current holder of the affected preferred stock.

All passed dividends on a cumulative stock make up a. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends. Dividends in arrears exist when a corporation has.

Any unpaid dividend on preferred stock for an year is known as dividends in arrears. A preference share is. Preferred stock can be cumulative or noncumulative.

These dividends have not. Preferred stock can be cumulative or noncumulative. Dividends in arrears relate to certain preferred dividends.

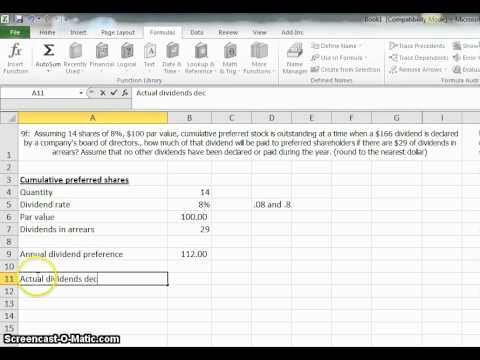

When a dividend is not paid in time it has passed. Omitted past dividends on the cumulative preferred stock. This means the company must pay 1 million to cumulative preferred.

Cumulative preferred stock that have not been declared for a given period of time. Dividends in arrears are dividends on. Cumulative Preferred Dividends in Arrears Should Be Shown in a Corporations Balance Sheet as What.

Without cumulative rights and with cumulative rights 6 100 par value preferred stock with 20000 shares issued and. Generally preferred stock will trade with a higher yield than the same. Dividends in arrears on cumulative preferred stock - Dividends in arrears on cumulative preferred stock A should be recorded as a current liability until.

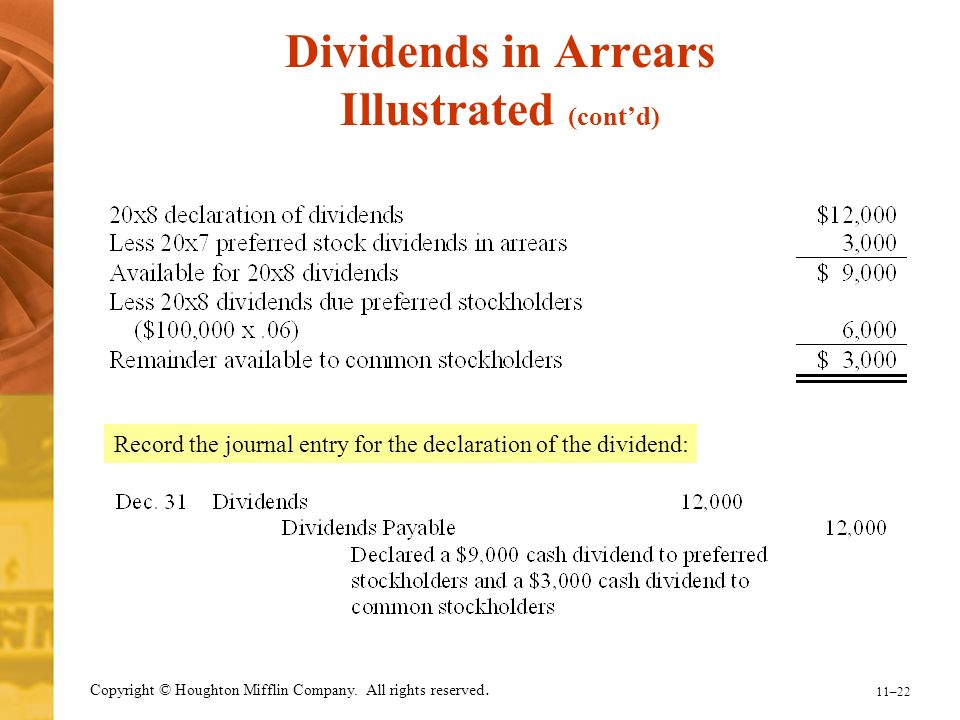

Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed. Disclosure of dividends in arrears on cumulative preferred stock. Allocating dividends between preferred and common stocks.

The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. If the prospectus says the preferred stock is non-cumulative there will be no dividends in arrears. When a dividend is not paid in time it has passed.

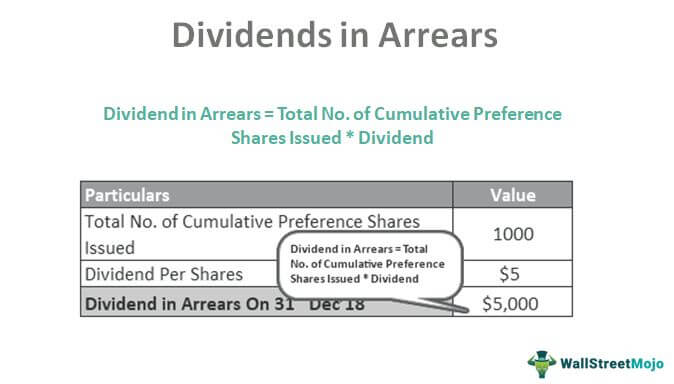

Common dividends that have been declared but have not. Continuing the example multiply 10 by 100000 to get 1 million in total dividends in arrears. A dividend in arrears is a dividend payment associated with cumulative preferred stock that has not been paid by the expected date.

Companies pay dividends by declaring a dividend and distributing the dividend later on the date of payment. There are 690000 preferred shares outstanding and the annual dividend. Dividends in arrears only apply to cumulative preference shares.

162 020 Pdf Preferred Stock Earnings Per Share

Pdf Chapter 7 Stock Valuation Ahmed Ismail Eissa Ismail Academia Edu

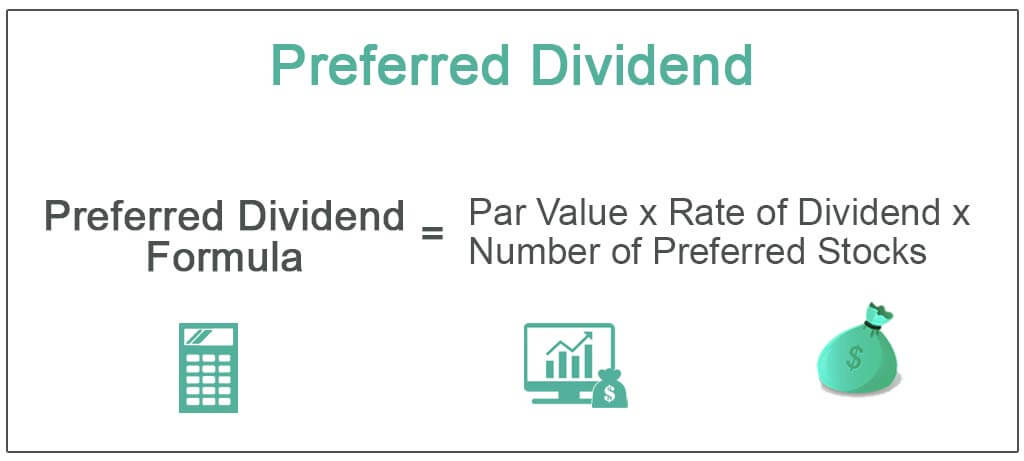

Preferred Dividend Definition Formula How To Calculate

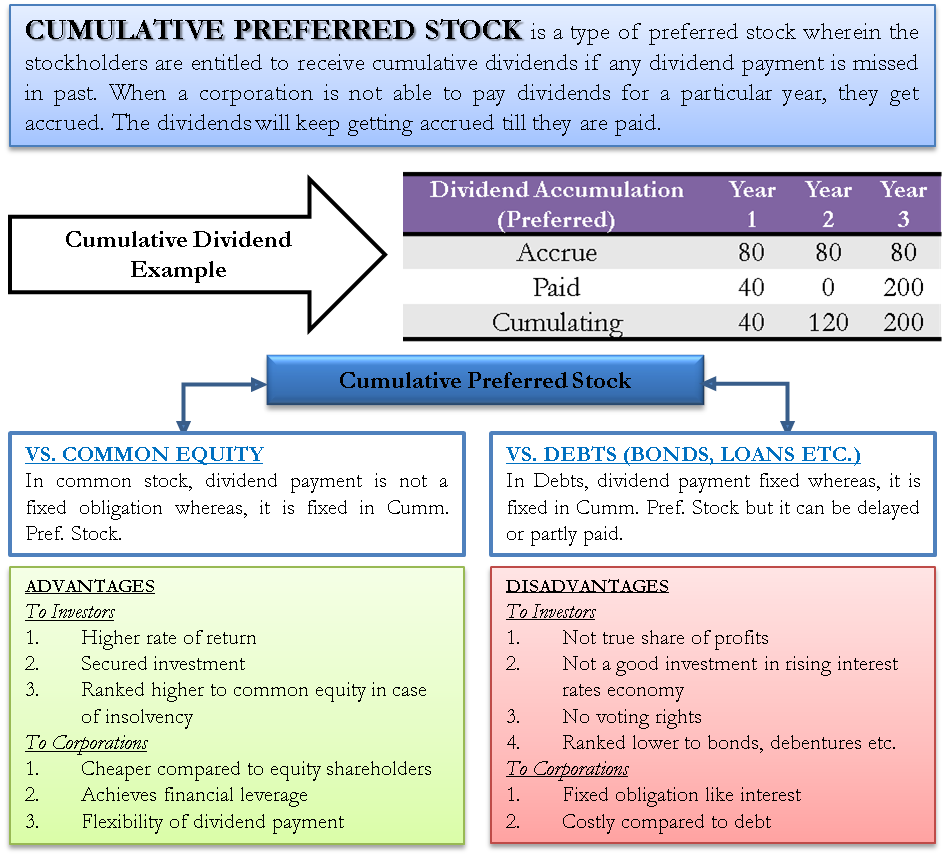

Cumulative Preferred Stock Define Example Benefits Disadvantages

Dividends In Arrears Meaning Features Examples

Solved Dividends In Arrears On Cumulative Preferred Stock Chegg Com

Corporations Paid In Capital And The Balance Sheet Ppt Download

Common And Preferred Stock Principlesofaccounting Com

Solved Financial Accounting Hw Problem Course Hero

Contributed Capital Skyline College Lecture Notes Ppt Download

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

What Are Preference Shares And What Are The Types Of Preferred Stock

Dividends In Arrears Definition Learn More Investment U

Solved Dividends Per Share Windborn Company Has 15 000 Shares Of Cumulative Preferred 3 Stock 150 Par And 50 000 Shares Of 10 Par Common Stock Cliffsnotes

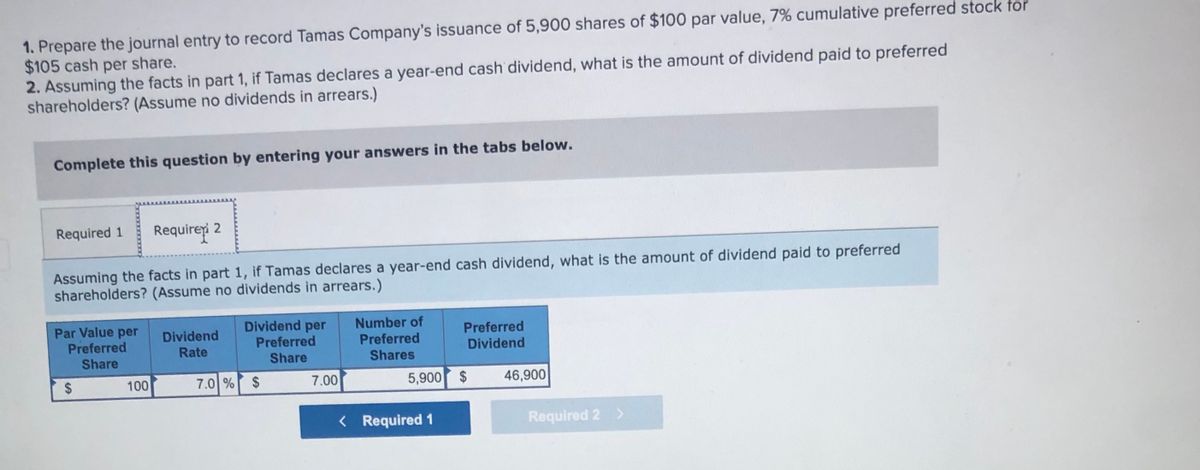

Answer To 1 Prepare The Journal Entry Record Tamas Companys Issuance 5900 Shares 100 Par Studyx

Solved Dividends Per Share Windborn Company Has 15 000 Shares Of Cumulative Preferred 3 Stock 150 Par And 50 000 Shares Of 10 Par Common Stock Cliffsnotes

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube